Shopify Q422 Earnings: Product Strategy Teardown

This is not a financial analysis of Shopify's latest earnings, but rather an examination of their product strategy, customer focus, the metrics they prioritize, and their areas of success and opportunity. Shopify's earnings can be accessed here

Shopify’s tagline “The all-in-one commerce platform to start, run, and grow a business (link)” is at its heart really a “commerce component” strategy. Every product they thoughtfully and diligently build is in service of this strategy. They have evolved their products to serve a wide range of businesses - from small mom-and-pop shops to large retailers and DTC brands, and then, a few famous celebrities and their pop-up stores. They serve online-only stores and those with a brick-and-mortar presence. “Make commerce better for everyone” is really “everyone”.

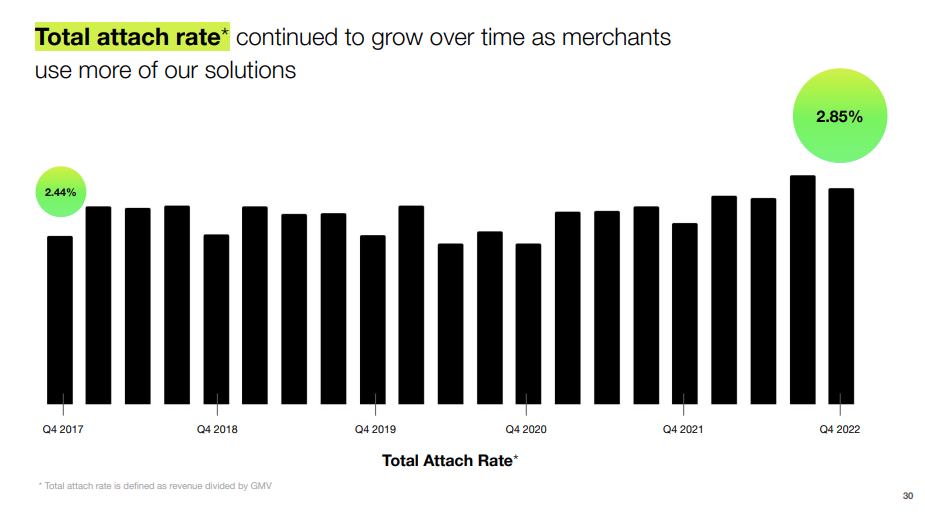

The metric that best reflects this “commerce component” strategy is their attach rate (Revenue / GMV), which serves as a proxy for how much value they extract from the services they provide to merchants. This metric also helps them gauge the amount of additional revenue they can expect to generate from existing customers. A growing attach rate indicates that customers are satisfied with their initial purchase and are likely to invest further in the company's products or services.

This single metric, Attach Rate, is the leading indicator of their future potential.

Source: https://s27.q4cdn.com/572064924/files/doc_financials/2022/q4/Webcast-Presentation-Q4-2022.pdf , https://investors.shopify.com/home/default.aspx

Currently, the majority of Shopify's revenue (1.3B out of 1.7B in Q4, 2022) comes from Merchant Solutions, with very little from subscription solutions. The larger brands, merchants, and retailers are more profitable (higher percentage of revenue) than smaller stores. If you look at their P&L with this lens, their winning customers are large enterprises with substantial budgets,. And their GTM strategy of plug ‘n play commerce components for brands and retailers is paying off as they successfully drive GMV and revenue growth through upselling into these accounts.

Here are some components they offer (as mentioned in their latest earnings), pick and chose what you need to stay competitive:

[Potential Opportunity] Customer Acquisition - Shopify Audiences, Social Shopping (FB/YT channels), Shop App.

Offline Experiences - POS Go, Tap to Pay, 14 countries

Online → Offline Experiences: Buy Online, Pick up in Store (BOPIS)

Product Quality - Shop Promise

[Major Revenue Driver] Payments - ShopPay, BNPL, Now in 22 Countries

Loyalty Programs

Shopify Capital - now at 4.7B$, Now in 4 countries

Shopify Tax

[Critical, but Cost Sink] Shopify Fulfilment Network for Fast and Predictable Shipping - Full e2e network built through partnerships and acquisitions. From Manufacturer → Freight → Distribution Hubs → Fulfillment Centers → Customers Porch

Not included in this list of commerce components are areas like (a) Broader and more holistic marketing tools, (b) Personalized browsing and search commerce experiences, and (c) Customer support tools. I am sure they are on their roadmap somewhat soon.